Finally, borrowers will be paying out much more in principal than interest and that's every time they can build equity inside their house A great deal more quickly. There are other costs Along with the regular house loan payments for your personal $140K house loan, for instance property tax, house insurance plan, HOA service fees, PMI, utility expenditures, and residential routine maintenance. Very first-time dwelling purchasers ought to keep an eye on these fees since they increase up quickly.

Obtaining a home loan for a house is actually very straightforward. I recommend these methods. one. Talk to your local bank. two. Try a mortgage provider to check out prices and obtain an online quotation. A property finance loan banker generally desires quite a few decades of tax returns as well as a statement within your assets and debts.

Use this loan calculator to find out your regular payment, desire fee, quantity of months or principal quantity on the loan. Come across your great payment by altering loan amount, desire charge and time period and looking at the effect on payment quantity.

Enter your details over to calculate the month to month payment. What's the down payment over a 140k house?

It is probable that only one quarter of 1 p.c can turn out preserving tens of thousands in excess of the length of your loan. Also, beware any expenses additional to your property finance loan. This can vary tremendously based on the mortgage loan provider.

It is really achievable that only one quarter of one percent can turn out conserving tens of countless numbers more than the duration from the loan. Also, beware any service fees added to your mortgage loan. This can vary tremendously dependant upon the property finance loan supplier.

They can also want particulars of your home obtain. Ordinarily, you're going to get an appraisal, a house inspection, and title insurance. Your property agent or bank can prepare this to suit your needs.

One of the astonishing factors I discovered is how a little difference in rates can have an effect on your total sum paid. Consider utilizing the calculator to check different curiosity charges.

Among the shocking items I uncovered is how a small big difference in costs can affect your complete quantity compensated. Try out using the calculator to examine various desire fees.

Insert assets taxes, insurance policies, and maintenance charges to estimate Total residence possession prices. Pay back the next down payment or refinance to reduce month to month payments. Really don't be afraid to ask your lender for superior prices. How do curiosity costs have an affect on a property finance loan of 140k in a 6 APR?

They'll also want facts of your own home purchase. Ordinarily, you'll get an appraisal, a home inspection, and title insurance policy. Your housing agent or lender can set up this for you personally.

This known as private house loan insurance policy, or PMI which happens to be a security that lenders use to safeguard by themselves in case of default through the borrower.

Whenever you acquire out a loan, it's essential to pay back back again the loan plus curiosity by generating common payments into the financial institution. In order to imagine a loan as an annuity you fork out to the lending institution.

5% curiosity charge, you'd probably be checking out a $503 month to month payment. You should Understand that the exact Price and regular monthly payment on your house loan will vary, dependent its duration and conditions.

Acquiring a home loan for a house is really pretty uncomplicated. I recommend these methods. 1. Talk to your neighborhood financial institution. two. Attempt a home loan service provider to look at charges and have a web based quote. A mortgage loan banker generally needs quite a few several years of tax returns as well as a assertion of your assets and debts.

It's also possible to develop and print a loan amortization plan to discover how your regular payment will pay-from the loan principal moreover fascination over the class with the loan.

Considering this loan desk, it's easy to discover how refinancing or having to pay off your read more home finance loan early can definitely have an effect on the payments of the 140k loan. Incorporate in taxes, insurance policy, and upkeep expenditures to get a clearer image of All round household possession expenses.

Neve Campbell Then & Now!

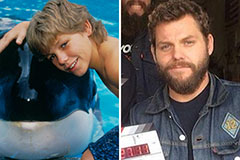

Neve Campbell Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!